This article explores the business model of display and programmatic companies. As our team executes digital campaigns, it became clear there was a growing and lucrative vertical that we wanted to learn more about. And so did potential clients. A question we get quite often is, what is programmatic advertising and does it make sense for my business?

If you want the answer now to save some time: probably not.

First: What is Programmatic Advertising:

Defined by the Display Trading Council as “the use of automation in buying and selling of media”.

Is Programmatic Display and Bid Management Right for My Business?

The root of the question is this: will I get a return on my investment in targeted display ads? To answer that, you want to understand (quickly) how online ads are bought and sold. You also want to identify what’s really going on behind the fancy diagrams, flashy websites and “superior value”.

The language on ad-tech and programmatic company websites is confusing at best and deceiving at worst. In writing this article, we found a lot of strange ambiguity and “behind the curtain” terms that, coming from a background in digital marketing, didn’t add up. Most of the programmatic advertising websites we visited had confusing visuals like the ones below to try and represent what they do.

The above diagrams look like something out of the Da Vinci Code. The left is programmatic ad delivery company Amobee and the right is AdTaxi. We’ll break down what the terms in the diagram mean in a minute.

How Much Do Display Ads Cost? You Should Know:

In the movie “The Big Short” the character played by Ryan Gosling is a lovable blood-thirsty capitalist. Basically, his firm offers swaps which is insurance on insurance on … well, it’s confusing. When asked what he gets out of offering this special mortgage swap to potential buyers, Gosling replies “Sure – swaps are a dark market so … I set the price, whatever price I want.” It seems that when working with programmatic bid management companies, the cost of online advertising is a dark market, and programmatic ad-exchanges are setting the price: whatever they want.

If you don’t know what a “fair” price is to pay for online ads, you’re certainly not alone. In fact, most programmatic ad-tech company employees don’t have a straight answer to this question . It’s nobody’s fault, but putting a benchmark in place will allow you to make a more informed decision.

Some Quick Definitions Before Diving in Head First:

Bid Management: When purchasing ads online, it’s the automated system set up to win the bid depending on the ad placement in the digital marketing campaign.

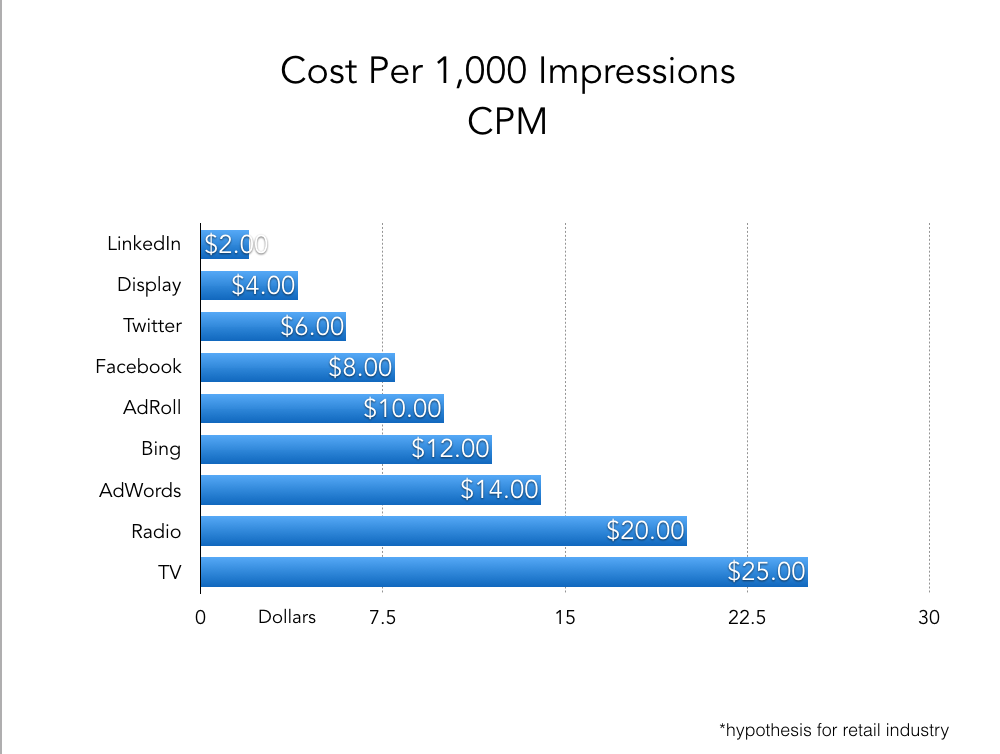

Cost Per Thousand Impressions: CPM: A standard measurement for how much online advertising costs. How much will it cost to show your ad to 1,000 people? You can easily break down your ad spend.

Display Ads: The ads you either see next to the article on your favorite newspaper website, or the ads you need to find the “x” to get out of.

DSP: Domain Side Platform: An automated buying platform used by programmatic ad-tech companies. This is the platform the company uses to purchase display ads from publishers (Google, Bing, third party). Banner ads = ads on websites, mobile ads on apps and mobile web and in-stream video.

Inventory: Total impressions online. Think of inventory like a billboard for a website. Your business can purchase 10,000 eyeballs. Once those are used up, the billboard changes to someone else’s message. How you select those 10,000 eyeballs is up to you. Perhaps you want your ad to appear in inventory only targeting males, ages 35-45 that are interested in tennis.

Questions To Ask of Programmatic Companies:

What should 1,000 impressions online cost?

According to HubSpot: the average cost for 1,000 impressions on display (if you see an ad, or an ad loads on your screen even if you don’t see it: that’s an impression), is $2.25. We’ve seen ad-tech companies charge anywhere from $15-$20 CPM. The next question you need to ask, is it worth it?

The $1,000 challenge: Would would happen if you bought direct? That means if you buy direct or through an agency that purchases direct and spend $1,000, you’ll deliver your ad 444,000 times. Let’s say you spent that same $1,000 with an ad-tech company, your ad would be served only 66,000 times. That’s a difference of 378,000 impressions. Is programmatic worth the cost?

What’s your cost-per-thousand-impressions online?

Again, CPM = what it costs you to show your display ad to 1,000 people online. After their surprise that you know what CPM is, they should give you a straightforward answer. If they don’t, be cautious. Programmatic advertising companies make it simple to bundle all of your advertising under one roof. Spoiler alert: it’s a very expensive roof. If the metric is readily available on their website, it’s a good sign of a transparent business model. If the number is not: you should find out what it is.

Purchasing direct (in-house) or with a digital marketing expert will cost around $2.25 per thousand impressions. Programmatic costs $15 per thousand impressions. About an 800% mark-up.

How do Programmatic Advertising Companies Make Money?

They charge a $15.00 CPM for for inventory they get at a discount. It’s a highly lucrative business model. It works because there’s not a lot of knowledge on exactly how much an online impression is worth.

Educate yourself: how much of a markup am I paying programmatic vs. buying direct through a marketing expert or through Google Ads? Or not using display ads at all? If you’re aware of the upcharge and it makes sense for your business: great.

Understand how much you’re willing to pay for 1,000 impressions and you’ll become a smart digital ad buyer. And no, Google Ads doesn’t own all the online inventory on the internet, but they can serve billions of impressions a day if you want them to.

Many programmatic advertisers are buzz-word heavy and marketing tactic poor. Words like “Premium Inventory” or “Ad Exchange Platform” are using inventory in platforms you can purchase direct like Google Ads, Facebook Ads, YouTube and Bing. Put the reporting in one place using Google Data Studio and you’ve potentially just saved tens of thousands of dollars a year.

Programmatic Ad Tech Business Model: Spend More Money.

Programmatic advertising companies make money when they sell more of their display, search, video and social ads at $15 CPM. If your YouTube ads are costing you $5 CPM direct, bundling that under the programmatic umbrella just bumped it up to $15. Is the “cross channel optimization” worth the mark-up?

The more CPMs they sell, the more money they make. The incentives for this model are so clearly backwards. The recommendation will always be to spend more money.

If you’re working with a team of marketing experts in a performance marketing firm, their answer to more sales, more inbound and more website visitors might not be more ad-spend. It might be public relations, content marketing or any of the other marketing traction channels that might yield higher results.

Below: Order for 334,000 programmatic display ad impressions at $4,850. The result, lots of impressions, zero landing page leads. Purchasing the same 334,000 through Google Ads would cost around $1,000.

Is My Programmatic Ad Team Also My Marketing Team?

No. Programmatic display ad firms are not marketing agencies: The individual managing your bid (where your ad is served) automation isn’t a trained marketing expert. Think of an Ad-Tech company the same way you’d think of the local television network selling you ad-space. You purchase a commercial, they deploy it strategically during shows and times they see valuable. If you bought a newspaper ad, would you say the newspaper ad salesman and the publisher handles your marketing? Programmatic tackles one small vertical of digital marketing: display.

Does Programmatic Advertising Work?

You’re going to be hard pressed to see a transparent return on ad-spend. Though, this is a question best answered by results and one you should be monitoring if you’re currently paying $15 CPMs. If you’re paying for programmatic and not measuring conversions. Stop. You’re donating money. Google announced Custom Intent Audiences at the end of 2017. As far as we’re concerned, this gives companies all the targeting capabilities they could ever need.

We’ve tested programmatic advertising at a cost of $15 CPM driving traffic to a landing page. The result? Programmatic spent $5,000 in automated display ads without a single form-completion while in-house paid social and paid search drove leads at around $11 cost-per-acquisition.

Here’s an article published by the Wall-Street-Journal describing a case-study with Proctor and Gamble. They cut millions of dollars from their programmatic budget. The result? “Little impact on its business, proving that those digital ads were largely ineffective.” Check out the article below:

“P&G Cuts More Than $100 Million In Largely Ineffective Ads”

“Proctor and Gamble, one of the largest advertisers in the country said that its move to cut more than $100 million in digital marketing spend in the June quarter (2017) had little impact on its business, proving that those digital ads were largely ineffective.

Chief Executive David Taylor said in an interview that the digital spending cuts are part of a bigger push by the company to more quickly halt spending on items — from ad campaigns to product development programs — that aren’t working.

“We shut it down. We’re not going to follow a formula of how much you spend or share of voice. We want every dollar to add value for the consumer or add value for our stakeholders.”

Bid Management Tools:

Programmatic Ad Tech companies will talk extensively about bid management and real-time bidding. These tactics haven’t proven (at least in tests we’ve done) to be more or less impactful for generating leads or sales. You may have heard of Marin Software. They are a bid management tool that claims to have cross channel premium inventory for advertisers to purchase. Here’s a look at their video:

Below: Display bid-management companies and ad-tech companies have a way of making bid management seem just ambiguous enough to work.

But … Marin Display Bid Management Stock: Yikes.

Display Dismay:

At the core of programmatic is display advertising. Banner ads, in-stream video and in-app advertisements. Do they actually result in sales? According to HubSpot, the average click-through-rate for a display ad is .35%. That means if 100 people in your hyper-targeted audience see your ad, you’re doing exceptionally well if you can get one person to show interest and click. Spending money on display if you have a fixed or performance based marketing budget is not where we would start.

I’m a Marketing Agency, Should I Partner With Programmatic Advertising Companies?

If you want full control over your ad message, landing page content and analytics, we’d strive for in-house management. Get familiar with purchasing direct and then decide if programmatic is something you want to explore. Plus having the in-house expertise to manage, contribute and grow your online acquisition channels would be highly valuable.

Run a Simple Test:

The easiest way to see if your programmatic partner is worth the high margins on ad-inventory is to test. Spend $5k in programmatic and run a $5k campaign internally. See what the cost-per-lead comes out to be. See how they track conversions and see the return. Does the money deployed toward hiring marketing professionals outperform the money deployed programmatically?

Below: DIY Google Ads makes it simple to deploy highly targeted display ads.

Who Makes Money on Display Ads?

Google AdSense is a pretty straightforward exchange. Let’s pretend you have a blog. You write content about roasting your own coffee beans. 1,000 people per day visit your website. You decide to rent a banner ad (inventory) from Google. You tell Google what your website is about. Google turns around and sells that banner ad space to advertisers. Starbucks, your local coffee shop and Folgers all want to show ads on websites for people interested in coffee. The blogger (you!) gets some money every time your ad is shown, and every time your ad is clicked.

That’s Google’s inventory, you can log-in to Google Ads or hire an expert in paid search to help build those campaigns. Programmatic Advertisers use a few different ad-exchanges, not just Google, to purchase ad-inventory and bid on when your ad appears. But as mentioned earlier, Google has a huge market share of ad inventory and an 800% mark-up to reach the remaining display ad placements and publishers is likely not worth it for your business.

Test Direct Vs. Programmatic Bid Management:

It could potentially save you thousands of dollars a month. Talk with a marketing agency and see how they would approach spending ad dollars: here’s a quick presentation I gave as part of an opening class to 50 seniors this spring at the University of Montana Marketing Analytics 440.

Testing Traction Channels > Programmatic Display

Below are the the 19 traction channels as described in the book “Traction” by Gabriele Weinberg. When working with a talented marketing agency, the goal is going to be testing traction channels. The incentive is to reach your goal, whether that’s through display ads or through blog and influencer outreach.

Programmatic Advertising lives in the display traction chanel: (No. 5 above). But that leaves a lot of other channels and gaps to test.

What Should We Do?

If you’re a small or mid-level business, we would not recommend your introduction to online advertising be with programmatic display. Paying for advanced bid-management tools is going to burn your potential marketing spend early. There are performance-based marketing firms you can hire that will help identify the three traction channels to focus on. If display ads are one of them, it might be time to entertain a conversation with programmatic. Perhaps there’s on-page website personalization to turn visitors into leads that might be more worth your time. Start at the center of your bullseye and figure out where your existing happy customers came from.

Hopefully after reading this article, you recognize the costs, the opportunity, and the risks of using programmatic ad-tech companies and also how to spot large CPMs behind ambiguous ad-tech diagrams.